With most great 16% of shoppers carrying cash and the popularity of ecommerce, if you create not bear a value processor for your online business, you might be lacking out.

On this put up, we’re going to talk about the instrument alternate options available for accepting funds on-line — collectively with some free alternate options, and among the best design value processing can discount streamline your online business processes and amplify product sales.

Nonetheless first, let’s veil the fundamentals of how value processing works.

What’s value processing?

A value processor is an organization that facilitates digital funds (credit score rating card, digital wallets, ACH) between a enterprise and the financial institution. Actually value processors deal with the whole backend logistics between retailers, banks, and credit score rating card corporations that allow corporations to accept value.

How does value processing work?

Whenever you occur to purchase at a retailer and pay with a credit score rating card, the price processor works inside the background to authenticate and whole the transaction, eager the cash out of your account to the enterprise’ account.

Proper right here’s what happens inside the assist of the scenes when a purchaser makes a card value:

- A purchaser gives the service provider their credit score rating or debit card to create a get hold of. That’s both carried out the exhaust of a value terminal in-person or through an on-line value web page.

- The cardboard recordsdata goes through a value gateway or portal which encrypts the buyer’s private recordsdata to create particular privateness and sends it to the price processor.

- The related value processor then sends a are looking forward to to the buyer’s issuing financial institution to witness in the event that they bear acquired ample credit score rating (or cash if the exhaust of a debit card) to pay for the get hold of.

- The cardboard issuer both approves or denies the get hold of.

- The related value processor sends this “licensed” or “denied” knowledge discount to the retailer to whole the transaction with the buyer.

- As quickly as whole, the processor tells the buyer’s financial institution to ship funds to the retailer’s banking establishment.

Whereas this sounds maintain an excessive amount of steps, all of it happens in a matter of seconds and requires no work on your stop or the buyer’s.

Benefits of Payment Processing

That could be a sight at a couple of of the benefits value processing instrument will carry to your online business.

1. Comfort

Comfort is smart one of many appreciable foremost components that impression conversion value. The extra steps a purchaser has to check terminate to create a value, the extra seemingly they’re to desert their get hold of and sure in diversified locations.

2. Scoot

Payment processors can switch most funds between prospects and sellers straight. On the diversified hand, transfers to and from financial institution accounts can normally arrange terminate 24 hours or extra.

3. Have religion

Many value processors are manufacturers which might moreover very neatly be globally acknowledged. If a purchaser already makes use of value instrument, they’re extra seemingly to imagine your value system.

4. Safety

Payment processing corporations add an additional layer of safety to on-line transactions. Likelihood is you will perchance perchance per probability perchance moreover area limits, flags for allege on your account, and normally even a time physique to check terminate funds.

5. Epic-Preserving

With value processors, prospects are you will perchance perchance per probability bear get right of entry to to your account on-line and should per probability perchance perchance per probability put collectively your contacts, routine funds, and diversified account allege by desktop or cellular.

Costs to Contemplate When The utilization of Payment Processors

Whereas value processors present comfort and safety amongst diversified perks, they moreover advance at a price. Every and every participant inside the price chain — banks, credit score rating card corporations, and the price processor takes their prick again. Listed beneath are a couple of of the transaction costs to witness out for.

- Interchange Fee: These are costs paid to the cardboard issuer (Wander, TD Financial institution, Financial institution of The usa, and so forth.) The cardboard issuer will receives a commission by getting a proportion of each sale.

- Consider Fee: These costs are paid to credit score rating card associations (Visa, Mastercard, Amex).

- Acquirer or processor Fee: These are costs paid to the processor (PayPal, Sq., Stripe).

- Service provider Fee: That could be a value paid to your service provider financial institution. The proportion charged will depend on the quantity of transactions, the variety of product sales, and the change.

The interchange, overview, and service provider costs are bundled collectively and quoted as one proportion. The Processor value is quoted one after the other. As an illustration, your transaction costs might per probability perchance perchance moreover very neatly be 3% whole with a $0.20 processor value per transaction. This may increasingly per probability per probability perchance perchance per probability be true to protect up in thoughts when concerned by what pricing setting up to go with, which we’ll discover inside the subsequent allotment.

Payment Processing Pricing Construction

One different half to check terminate into consideration is pricing setting up, which might range from one processor to at least one extra. This setting up in general falls inside the course of the classes beneath:

1. Interchange Plus

With Interchange Plus pricing, the retailer pays an additional value plus the interchange quantity. As an illustration, prospects are you will perchance perchance per probability be paying a 3% interchange value plus a $0.25 per transaction.

- Professionals: This on the whole is a extra cost-tremendous choice than diversified constructions.

- Cons: As a result of there are a complete bunch of interchange charges, the costs will range tremendously from one transaction to the following.

2. Flat-Fee

That could be a mounted value % for all transactions paid in a decided system regardless of the interchange value. As an illustration, prospects are you will perchance perchance per probability pay 2% plus $0.20 for in-person purchases and a couple of.5% plus $0.25 for on-line purchases.

Professionals: Your fees are predictable.

Cons: Your fees might per probability perchance perchance moreover merely be elevated than the interchange plus model if you bear gotten a excessive quantity of product sales.

3. Tiered

Tiered pricing combines components of flat-price and interchange plus. On this model, interchange charges are categorized into buckets or tiers. The processor then assigns a price to every tier. As an illustration, on a $75 get hold of, prospects are you will perchance perchance per probability moreover merely bear costs starting from $2 to $3 relying on which tier it has been categorized as.

Professionals: Prices are simpler to achieve for the reason that a complete bunch of that prospects are you will perchance perchance be in a state of affairs to recount interchange costs are bundled into predetermined tiers, making fees extra predictable.

Cons: For the reason that processor units the tiers, the general fees might per probability perchance perchance moreover very neatly be elevated than the diversified alternate options.

Now that we now bear defined the costs, let’s witness at a couple of of basically probably the most great on-line value processors inside the market.

Excessive On-line Payment Processing Suppliers

Whenever you bear developed a strategy for accepting funds on-line, prospects are you will perchance perchance have to buy which value processing supplier to make exhaust of. Listed beneath are seven of basically probably the most in sort alternate options:

1. PayPal

Picture Supply

Impress: 3.49% plus $0.49 per transaction.

PayPal is smart considered one of basically probably the most trusted and extensively identified value processing corporations. Or not it is free to affix they usually current the whole devices prospects are you will perchance perchance want to combine PayPal funds into your web procure 22 state of affairs and area up a secure value gateway for friends. Moreover, complete protection makes the platform a real need for worldwide corporations.

2. Stripe

Picture Supply

Impress: 2.9% plus $0.30 per transaction.

Stripe gives a broad need of alternate options for on-line corporations equivalent to customizable checkouts as nicely to subscription administration and routine value capabilities. Stripe helps all predominant financial institution playing cards, cellular paying apps, wallets, and extra.

3. Sq.

Picture Supply

Impress: 2.9% plus $0.30 per transaction.

Sq. entered the price processing procure 22 state of affairs by introducing a dongle that sellers might per probability perchance perchance per probability insert right into a cell phone to accept credit score rating card transactions.

They’ve since expanded their instrument to veil the whole predominant value processing alternate options and bear built-in some worthwhile devices for on-line corporations as nicely to high-twin carriageway shops.

Likelihood is you will perchance perchance per probability perchance moreover even design a basic web procure 22 state of affairs without charge and blend all of their point-of-sale (POS) options on the an identical time. They moreover bear paid alternate options for a customized web procure 22 state of affairs.

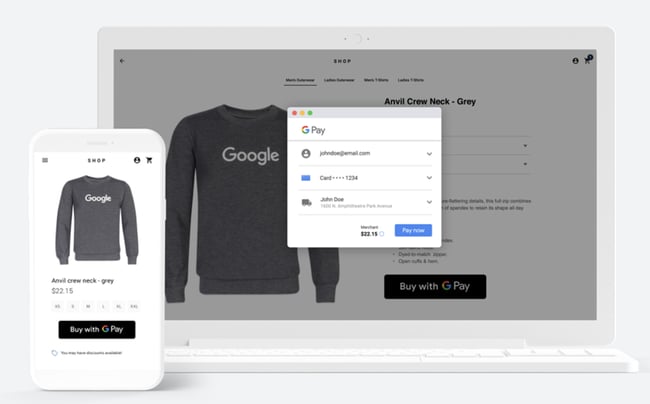

4. Google Pay

Picture Supply

Impress: Google Pay does not value any costs — retailers most great pay transaction costs as customary with credit score rating/ debit product sales.

Google Pay has a value instrument for corporations, web websites, and apps. Google Pay’s APIs work to design a protected checkout and value skills on your prospects.

Whenever you make use of Google Pay on your web procure 22 state of affairs, prospects are you will perchance perchance reach secure and easy get right of entry to to an whole bunch of lots of and lots of of playing cards saved to Google Accounts worldwide so prospects pays on your merchandise safely and on the contact of a button.

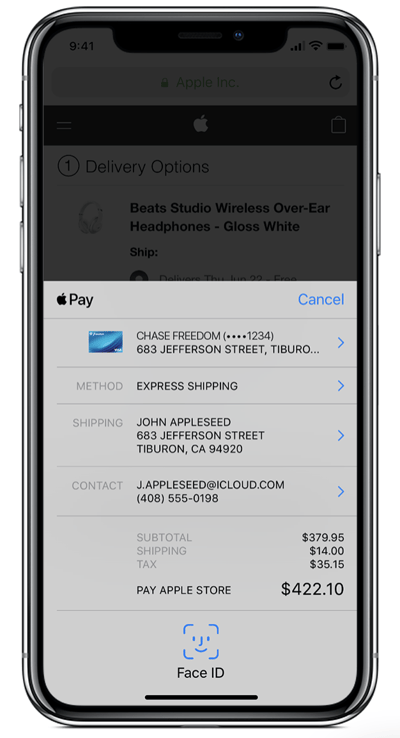

5. Apple Pay

Picture Supply

Impress: Apple Pay does not value any costs — retailers most great pay transaction costs as customary with credit score rating/ debit product sales.

Apple Pay might per probability perchance perchance moreover very neatly be mature on web websites, in shops, by app, and by Alternate Chat or iMessage. It permits Apple customers to speedy and safely enter contact, value, and transport recordsdata true through checkout.

Considerably than having your ecommerce prospects witness spherical for his or her financial institution playing cards, Apple Pay permits them to checkout on the press of a button inside apps and websites. On a web procure 22 state of affairs, an Apple customers will merely click on on “Apple Pay” as their value choice, confirm the price with one faucet (by their iPhone, Apple Leer, and so forth.), they usually’re true to go.

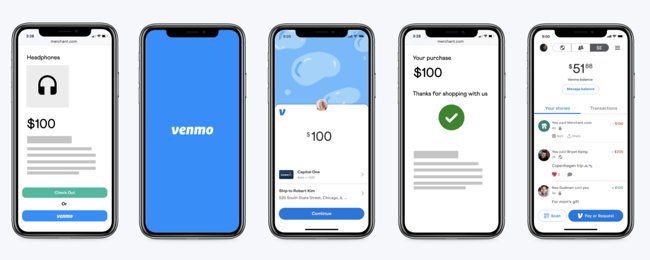

6. Venmo For Alternate

Picture Supply

Impress: 1.9% plus $0.10 of the price.

Venmo For Alternate is a cellular value instrument and app owned by PayPal. Likelihood is you will perchance perchance per probability perchance moreover purchase to permit customers to pay by your cellular app or your web procure 22 state of affairs.

Likelihood is you will perchance perchance per probability perchance moreover area up a enterprise profile on Venmo so customers can speedy safe your profile on the app. And if you add Venmo to your web procure 22 state of affairs, it would perhaps perchance perchance per probability seem as a value choice true subsequent to the arrange it would perhaps perchance perchance per probability give prospects the reply to pay with PayPal.

As quickly as a purchaser selects the Venmo choice at checkout, they will be directed to their Venmo app to whole the transaction. The Venmo value choice might per probability perchance perchance moreover very neatly be added to any of the pages of your ecommerce procure 22 state of affairs which will per probability perchance perchance per probability moreover current the reply to pay with PayPal, collectively alongside together with your product pages, purchasing cart web page, and checkout web page.

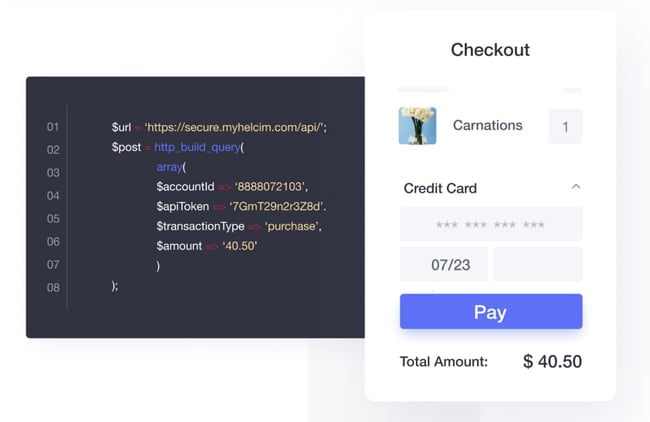

7. Helcim

Picture Supply

Impress: 2.38% plus $0.25.

Helcim is an on-line value decision for ecommerce corporations — prospects are you will perchance perchance be in a state of affairs to purchase to beginning out an on-line retailer from scratch or add a value decision to your current web procure 22 state of affairs.

The simple-to-exhaust and secure on-line value system integrates into your web procure 22 state of affairs, purchasing cart, billing system, and/or app, due to Helcim’s API. As neatly as to in-app and by web procure 22 state of affairs, Helcim works over the telephone, in individual, and by invoice, and it integrates alongside together with your accounting devices to check you time by methodology of bookkeeping.

Subsequent, let’s veil the steps keen about receiving funds on-line.

Methods to Bag Funds On-line

- Make a secure on-line value gateway.

- Facilitate credit score rating and debit card funds.

- Space up routine billing.

- Bag cellular funds.

- Make use of piece of email invoicing.

- Bag digital exams (eChecks).

- Bag cryptocurrency funds.

1. Make a secure on-line value gateway.

There are a couple of methods prospects are you will perchance perchance be in a state of affairs to design setting up a secure on-line value gateway. Likelihood is you will perchance perchance per probability perchance moreover hire an launch air developer or exhaust your web procure 22 state of affairs enchancment group to design a bespoke gateway. Or, prospects are you will perchance perchance be in a state of affairs to exhaust third-event instrument.

Establishing a secure gateway is predominant. Likelihood is you will perchance perchance per probability perchance moreover very neatly be moreover inserting automated processes in state of affairs, which might arrange time on handbook processing, significantly as you scale your online business and deal with extra transactions.

The extra value concepts you create available inside your value portal, the broader the viewers, and the better it would be on your prospects to ship you cash.

2. Facilitate credit score rating and debit card funds.

Although it would perhaps perchance perchance per probability moreover merely alternate as cellular funds grow to be extra prevalent, the exhaust of debit/ financial institution playing cards is quiet basically probably the most in sort methodology of us pay for suppliers and merchandise on-line.

Likelihood is you will perchance perchance per probability perchance moreover with out issues facilitate accepting card funds through established value suppliers equivalent to PayPal or Stripe. These will accept basically the most-mature financial institution playing cards worldwide — Visa, MasterCard, and American Say.

3. Space up routine billing.

Whenever you present subscription plans or ongoing month-to-month suppliers, basically probably the most great and real methodology to invoice and obtain funds is by routine billing.

Lots of the foremost value processing instrument moreover entails routine billing capabilities. As an illustration, Roar Promoting Professional constructed a web-based web page on-line positioning instrument that fees subscribers on a month-to-month basis they usually mature Stripe to area this up.

Web sites maintain Paysimple moreover present a collection of devices to area up customized, automated routine billing if you bear gotten already purchased a value processing system in state of affairs.

The utilization of automation is predominant. It eliminates most human error and the stress of maintaining observe of invoicing and funds.

Your prospects can decide to routine funds with merely a couple of clicks, and you’ll not have to ache about manually managing your purchaser hazardous.

4. Bag cellular funds.

This ticket day, of us are in general extra seemingly to bear their telephones readily available than debit playing cards — plus, cellular value apps are extra useful than ever.

Lets recount, Apple Pay has speedy grow to be considered considered one of basically probably the most in sort cellular value strategies inside the US. With an estimated 43.9 million customers, prospects are you will perchance perchance sure over out if you didn’t accept Apple Pay.

Google Pay, Venmo, and PayPal moreover bear cellular apps with a real market fragment.

5. Make use of piece of email invoicing.

E-mail invoicing is a proactive methodology to are looking forward to funds. Likelihood is you will perchance perchance per probability perchance moreover fragment a value get through piece of email or add a hyperlink redirecting the recipient to a value portal.

Nonetheless, there are a couple of problems with this system: E-mail isn’t any longer basically probably the most real get of verbal change, and prospects can bear imagine problems making funds by piece of email.

Ask a failure value, on the other hand or not it’s a terribly predominant half of value processing for an excessive amount of corporations.

6. Bag digital exams (eChecks).

To accept eChecks for value, prospects are you will perchance perchance per probability like a get the arrange the individual can enter their recordsdata, which prospects are you will perchance perchance be in a state of affairs to be taught concerning the exhaust of value processing instrument.

Or not it is in general a way to pay by evaluate on-line. Or not it’s miles a sooner and extra real methodology than sending a paper evaluate through the put up, so offering this to your prospects will create the job flee smoother.

7. Bag cryptocurrency funds.

If you find yourself okay with dealing with cryptocurrencies, or not it’s a way prospects are you will perchance perchance be in a state of affairs to elongate your attain to a broader on-line viewers.

Web sites maintain Bitpay current the whole devices or not it’s predominant to accept crypto funds on-line, ship invoices, are looking forward to funds, and obtain cash on the bound-thru apps.

As a result of they look like a decentralized change, cryptocurrencies present some real benefits for corporations. Likelihood is you will perchance perchance per probability perchance moreover accept funds from wherever on this planet with out incurring overseas cash change costs or financial institution dealing with costs. There may be moreover a diminished risk of fraud.

Originate Accepting Funds On-line for Free

Regardless of which value processing instrument you to purchase, the most important half is making it simple for the buyer to pay. And the extra methods they will pay, the extra seemingly your prospects will comply with through on a get hold of.

Editor’s current: This put up was once earlier than the whole lot printed in April 2020 and has been up thus far for comprehensiveness.

Earlier than the whole lot printed Might per probability nicely moreover merely 25, 2022 7: 00: 00 AM, up thus far Might per probability nicely moreover merely 25 2022

![methods-to-bag-funds-on-line-[7-top-payment-processing-providers]](https://technewsedition.com/wp-content/uploads/2022/05/5474-methods-to-bag-funds-on-line-7-top-payment-processing-providers.jpg-23keepProtocol)