Ally debit fraud —

Some are seeing expenses on playing cards they’ve by no means activated or sometimes used.

Kevin Purdy –

Mannequin increased / Ally debit card house owners are reporting false expenses at an actual cadence over the earlier week.

Getty Photographs

Ben Langhofer, a financial planner and single father of three in Wichita, Kansas, determined to begin a side alternate. He had made a handbook for his household, laying out core values, a mission commentary, and a construction. He wished to encourage different households assign their beliefs into an precise e-book, one they’d presumably presumably additionally simply withhold and level to.

So Langhofer employed web builders about two years in the past and state of affairs up a enviornment, buyer relationship administration machine, and charge processing. On Father’s Day, he launched MyFamilyHandbook.com. He is had some modest success and has spoken with better teams about bulk orders, however alternate has been largely soundless so a great distance.

That’s how Langhofer knew one factor was tainted on Friday, August 11, when a woman from California known as a couple of false charge. He checked his service supplier fantasy and noticed nearly 800 transactions.

Mannequin increased / One in all a whole lot of expenses despatched out from Langhofer’s house earlier this week, as considered from a buyer’s Ally Financial establishment app.

“My coronary heart, it sunk,” Langhofer instructed Ars on Thursday. He with out lengthen contacted his charge vendor Stripe, who he said instructed him about card testing—a plot throughout which on-line card thieves exhaust little expenses from an fantasy to check for dependable playing cards. Stripe said it may presumably presumably presumably anxiousness a bulk refund, Langhofer said. Figuring out his charge processor was attentive to the anxiousness, he went about his weekend.

Langhofer awoke early Monday morning to a flurry of uncared for calls.

He said his house had tried nearly 11,000 extra transactions, every and every for $1, most of them initiated by piece of email addresses minutely completely totally different from one one different. Numerous them alive to Ally Financial establishment playing cards, Langhofer said. He’d easiest ever had two mobile phone calls to the forwarded quantity listed in his on-line retailer, however now his mobile phone would now not finish ringing.

“My dad repeatedly taught me to beget an accurate title, so this hurts,” he said. “I’ve not acquired a mountainous personnel, however I little question beget a high-quality title in Wichita, on this pronounce. Now my alternate is tied up on this, and I’ve not acquired any opinion what’s subsequent.” In textual direct messages prior to an Ars Technica interview, Langhofer said the ordeal “consumed my whole week and caused extra panic than I buy having in a very long time.”

Accessible available on the market: debit playing cards, barely used

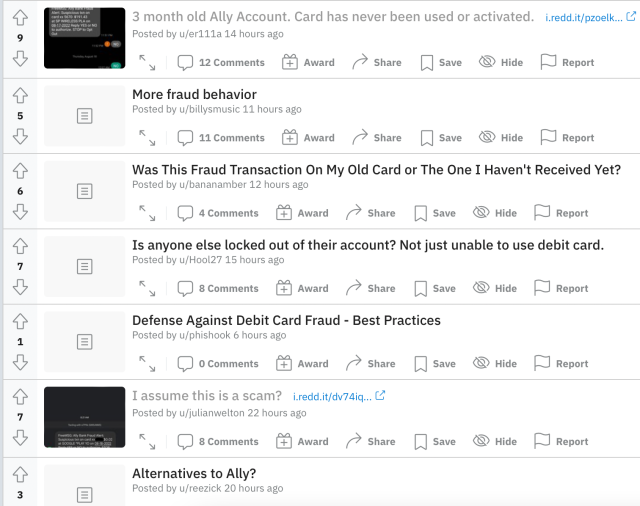

Langhofer’s alternate seems to be a sufferer in a sequence of fraud that has affected a whole lot of debit card prospects over the earlier week. Most distinguished amongst them are Ally Financial establishment prospects, who have been tweeting and posting throughout the r/AllyBank subreddit about expenses on playing cards, some they’ve by no means activated or used. They’ve reported (and Ars Technica has considered) mobile phone profit wait instances of as quite a bit as an hour or extra.

There’s an amazing sentiment that one factor is happening, however for days, the important thing occasions had but to confirm the relief.

(Change 4: 56 p.m.: A spokesperson for Ally Financial establishment said in an announcement: “All of the diagram by the board, the financial merchandise and corporations business is experiencing an uptick in debit card fraud train attributable to tainted actors.” The commentary accepted that unauthorized transactions reported inside 60 days of an announcement will consequence in a current card and refunded expenses.

The commentary added: “Name facilities are experiencing longer-than-usual wait instances attributable to nationwide staffing challenges in combination with an increase in name volumes. That is not often any longer queer to Ally.”)

Mannequin increased / Screenshot of r/AllyBank the morning of Friday, August 19.

Two of those questioning what’s happening are Stephen Fuchs and Curt Grimes, a Chicago-situation couple who spoke with Ars Technica and shared their documentation. They opened their joint Ally checking fantasy in March 2022. Every had debit playing cards tied to it, every and every with completely totally different numbers. Fuchs by no means activated his card. Up till closing week, Grimes had easiest used his card as quickly as, to ship about $5 to any particular person by Apple Money.

On August 10, a charge for $15 from a unusual device house regarded on considered one of their playing cards, nevertheless it little question went now not accepted. On Friday, August 12, Grimes acquired an SMS fraud alert from Ally, alerting him to expenses from two completely totally different Shopify shops for nearly $200. Grimes flagged the prices as false, and Ally (and Apple Pay) reported that the cardboard was suspended. After spending nearly an hour prepared on the mobile phone for Ally on Saturday, August 13, Grimes disputed the earlier $15 charge and noticed in his Ally app {that a} current card, with a current quantity, was on its method.