If you are going to agree with watched the information not too extended in the past, it appears to be like to be that the likely for a recession has captured all people’s consideration.

Americans agree with already considered indicators benefit from the inflation of hire, fuel costs, groceries, and different necessities that pre-present wages can’t meet. However, peaceful, some consultants bellow that we could peaceful avert a recession – and if we originate not – a recession could not closing as extended as 2008’s.

With all these changes and newsbites in ideas, business determination-makers may probably probably nicely shock how their likely potentialities are reacting. And, if their spending habits shall be altering inside the shut to future because of this?

Whereas we originate not know if we are going to head correct right into a recession, this put up objectives to attend on manufacturers and entrepreneurs put collectively to proceed to satisfy patrons the place they’re – even in uncertain conditions.

To current readers perception on how spending behaviors are or shall be shifting, we surveyed greater than 200 U.S. patrons inside the route of all age teams.

Sooner than we dive in, we are going to briefly show the concept of a recession:

What’s a recession?

A recession is a continual downturn in monetary train that happens when the worth of things and corporations falls for 2 or extra consecutive quarters. This business cycle contraction exhibits not best the lowered price of things however moreover lowered earnings phases, industrial manufacturing, and inventory costs.

Recessions are a typical portion of the business cycle and should even be induced by world monetary shocks, changes in consumer self notion, and different super-scale monetary changes.

However this one 12 months, in express, there are a resolve few components that agree with spurred dispute a couple of likely recession, even although one peaceful hasn’t been declared or confirmed.

For extra on the explanation on the assist of recessions and why some are involved about them happening inside the shut to future, check out out this treasured put up from our companions at The Hustle.

How Particular person Spending Habits Is in all chance Altering

We carried out a Search for gaze of U.S. patrons to cost how they exhaust their cash and the way monetary uncertainties get pleasure from recession may probably probably nicely have an effect on them. Proper right here is how they replied to our questions:

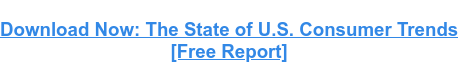

1. How has the information of a likely US recession impacted your spending habits?

Although a recession is not however apparent, most respondents are purchasing much less and spending cash extra concisely than they had been in outdated months.

Rising prices of things and corporations on the overall motive patrons to alter into extra cautious in frivolous spending, and we’re certain Americans are feeling the results come up quickly.

As a marketer or tag chief, now can even very correctly be an accurate time to arrange in ideas reductions, product sales, offers, or freemium promoting and advertising and advertising. Whereas of us are doubtlessly tightening their wallets, they peaceful may probably probably nicely have interaction objects, corporations or experiences which are smart or current bang for his or her buck.

How Spending Might probably nicely nicely Swap In a Recession

When consumer spending habits, it’s on the overall contingent on supply air components, and information of mammoth changes inside the financial system is value taking a discover into. Under is the distribution of varied consumer alternatives and the way they’d acknowledge to monetary uncertainty or a likely recession inside the extended lunge.

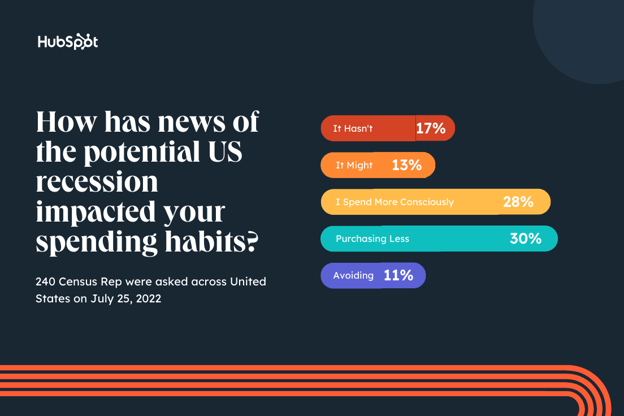

2. If a recession is asserted, how will your bear home funds change inside the precept three months of this uncommon monetary era?

Unsurprisingly, most patrons polled (64%) bellow they’d lower or proceed to decrease their home funds if a recession became declared.

As of June, inflation hit 9.1%, a historic uncommon excessive by the Federal Reserve. However, wages aren’t transferring to match these more and more extra quickly changes. Naturally, the ultimate public is already procuring for concepts to information decided of breaking the financial institution — by decreasing their budgets.

Should you market B2C manufacturers, or merchandise which may probably probably nicely be ragged specifically inside the home, proper here is important to alleviate in ideas if monetary uncertainty continues. While you may not alarm and alter your whole promoting and advertising and advertising method over mighty one restricted gaze, you may probably probably maybe nicely are looking to arrange in ideas concepts get pleasure from promoting and advertising and advertising your top, discounted, or mandatory merchandise over greater-priced or luxurious objects.

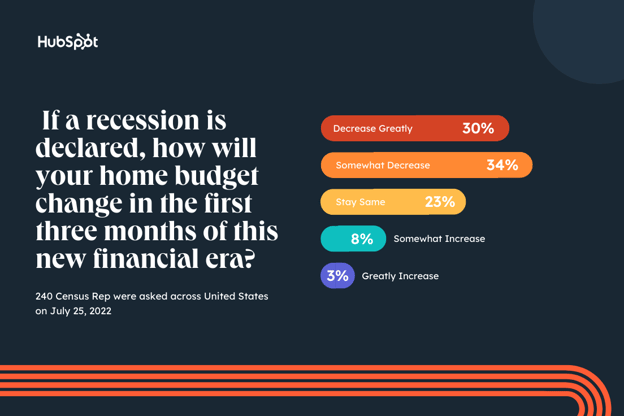

3. Legitimate via uncertain monetary conditions, what did you exhaust essentially the most cash on?

We additionally requested patrons to repeat on their purchasing habits in outdated monetary eras with the demand of, “Legitimate via uncertain monetary conditions (equal to previous recessions or correct via the COVID-19 pandemic), what did you exhaust essentially the most cash on?”

When surveyed, essentially the most nice objects patrons agree with supplied in uncertain conditions are normally concept to be frequent necessities.

- A necessary Groceries and Meals

- Lease, Mortgage, Housing Payments

- A necessary Private Care Merchandise

- Treatment and Healthcare

The rules exhibits a shift to self-preservation and not extra on looking for pleasure or taking over risks comes as no shock. By inserting off prices for leisure or leisure, of us may probably probably even be apparent their households are regarded after earlier than taking their buck to achieve points get pleasure from supply a business, recall a stroll to the movement footage, or put money into an unpredictable market.

The proper information? This does not essentially imply there shall be a complete shut in retail, leisure, or different non-necessary corporations. Bigger than 10% peaceful perception to take a place in digital or on-line leisure, spherical 7% would peaceful put money into eating places and bar outings – along with coaching and lecturers, and over 16% would put money into clothes and attire, So, not like the pandemic, we doubtlessly could not question total economies pack up totally for months at a time.

How an Upcoming Recession Might probably nicely nicely Fluctuate from 2008

There are only a few key variations between this recession and that of 2008, primarily inside the components that induced it and its projected length.

In accordance to Morgan Stanley, the likely recession shall be largely pandemic-induced and credit-pushed.

COVID-associated fiscal and financial stimulus contributed to inflation and drove speculation in monetary assets. Proper right here is extremely different from the Monumental Recession of 2008.

The 2008 recession became attributable to debt-associated excesses constructed up in housing infrastructure, which took the financial system practically a decade to recall in. Towards this, extra liquidity, not debt, is the in all chance catalyst for a recession today.

Ensuing from the difference in causes, consultants at IMF predict a model uncommon recession shall be fast and shallow.

Key Takeaways for Companies in 2022

As entrepreneurs, we’re not consultants in monetary markets and should not be considered as a present for funding, HR, and mighty recommendation. And, nobody ever is aware of for apparent if or when there shall be a recession.

It’s additionally to alleviate in ideas that, whereas the implications above can fully current assist to navigate the right way to market your tag, they’re mighty a share of 1 restricted gaze and a brief discover into the eyes of potentialities. Sooner than making any main alternatives about your promoting and advertising and advertising division, exhaust, or business, you completely should attain your study, analyze a pair of knowledge features, and search the recommendation of consultants in your business.

Whereas your alternatives have to be based totally on a deep dive of knowledge, the gaze outcomes above attain clarify that entrepreneurs have to be cautious about how their efforts can agree with to pivot with altering consumer desires or inclinations.

Listed under are only a few takeaways to alleviate in ideas.

- A recession today could not be the similar as 2008. Whereas patrons seemingly will tighten budgets and probe for merchandise that current essentially the most price or necessity for his or her buck, they could not be in detrimental monetary situations. They’d probably maybe peaceful be persuaded to interact a mighty product that is marketed to them inside the approaching months.

- Market your product’s affordability, price, and/or necessity: As patrons and corporations tighten their budgets, making product sales, sustaining potentialities, and persuading of us to interact non-necessary merchandise shall be extra exhausting. Be apparent you might be promoting and advertising and advertising that your product has added price or significance, different than being flashy, uncommon, or frigid.

- Entrepreneurs may probably probably nicely are looking to discover extra mark-fantastic concepts. (Ponder decreasing extra advert exhaust and specializing in pure social, web web page positioning, or electronic mail promoting and advertising and advertising as a change.)

Keep in mind, monetary uncertainties – and even recessions – are frequent. And whereas it’d probably probably probably nicely grow to be extra exhausting to recall potentialities inside the approaching months, business and patrons will peaceful relieve transferring (and making purchases) concurrently we look ahead to the cycle to lunge its route.

First and most important revealed Aug 29, 2022 7: 00: 00 AM, up as loads as now August 29 2022

![is-the-doable-recession-already-impacting-particular-person-spending-habits?-[new-data-+-takeaways-for-marketers]](https://technewsedition.com/wp-content/uploads/2022/08/7311-is-the-doable-recession-already-impacting-particular-person-spending-habits-new-data-takeaways-for-marketers.jpg-23keepProtocol)