[ad_1]

India’s high banks 5 years in the past constructed the interoperable UPI railroads and enabled over 150 million individuals within the South Asian market to pay digitally. Scores of corporations — together with native corporations Paytm, PhonePe, CRED and worldwide giants Google and Fb — in India right this moment assist the UPI infrastructure, which is now reporting 3 billion transactions every month.

Banks are actually prepared for his or her second act.

On Thursday, eight Indian banks introduced that they’re rolling out — or about to roll out — a system known as Account Aggregator to allow shoppers to consolidate all their monetary knowledge in a single place. (Individuals banks are HDFC, Kotak, ICICI, Axis, SBI, IndusInd, IDFC, and Federal Financial institution. 4 of them are rolling out the system Thursday, others say they’ll roll out the brand new system quickly.)

The target of Account Aggregator (AA) is to combination all monetary info of a person, stated M Rajeshwar Rao, Deputy Governor of India’s central financial institution — Reserve Financial institution of India — at a digital occasion Thursday.

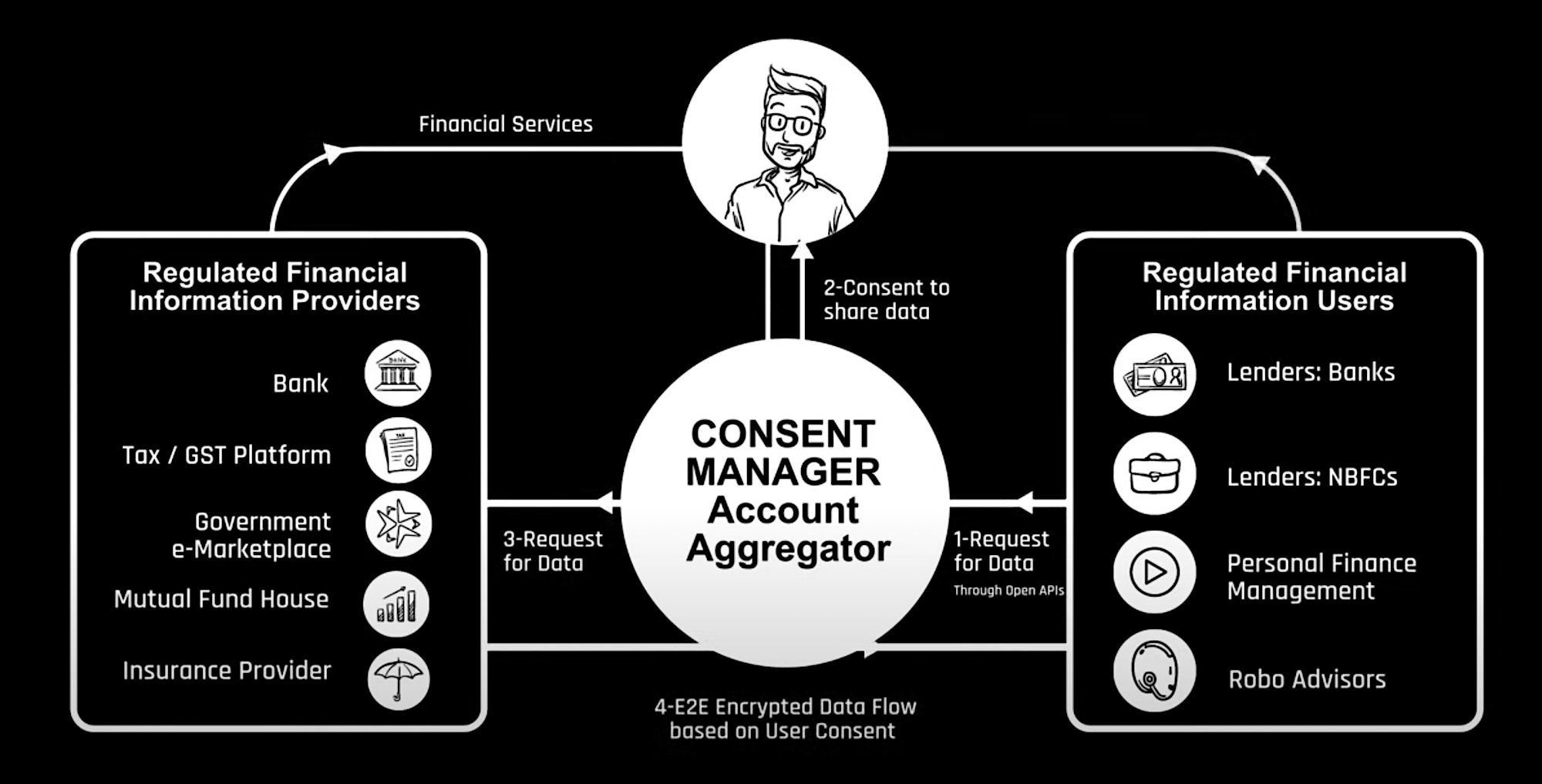

The brand new system makes it potential for banks, tax authorities, insurers, and different finance corporations to combination knowledge of shoppers — who’ve offered their consent — to get higher understanding about their potential prospects, make knowledgeable selections and guarantee smoother transactions.

Customers who present consent — and it solely takes a number of faucets to take action — will be capable of share their monetary info from one Account Aggregator participant to a different by means of a centralized API-based repository. Customers get to determine for the way lengthy they need their knowledge to be shared with a specific Account Aggregator participant.

“For retail mortgage underwriting (“eligibility examine”), fairly than submitting earlier 3 years financial institution statements, I can merely authenticate an information switch by way of AA (and revoke the info switch AFTER the mortgage is accredited or sanctioned). For self-employed or freelance professionals, getting Time period Insurance coverage has at all times been tough since they can not show their earnings – AA enables you to present an audit path of previous earnings to underwrite the Time period Insurance coverage software,” Rahul Mathur, founder and chief government of insurance coverage aggregator startup BimaPe, informed TechCrunch.

An illustration of how the AA system works.

Account Aggregator is constructed partially to assist shoppers and companies entry monetary companies akin to loans. Current credit score bureaus in India have knowledge of solely a fraction of the nation’s 1.4 billion inhabitants, which makes it very tough for many within the nation to entry working capital, defined Infosys chairman Nandan Nilekani, who’s been an adviser to Account Aggregator, on the occasion Thursday.

“Talks are on to onboard telecom operators as nicely,” he stated, including that the system has already achieved the sophistication that it may very well be prolonged to different industries.

“It’s an structure that may now be utilized to a number of extra industries,” he stated, pointing to healthcare, health, testing labs as examples. “We are able to confidently say that there is no such thing as a different nation on the earth that has constructed a strong infrastructure of this type and at scale the place its individuals can leverage their knowledge. This strategy is now getting international recognition.”

The Account Aggregator system can also be positioned to dramatically enhance the addressable marketplace for on-line insurers, lenders, and gamers in a number of different industries.

“It is a huge step in direction of a related monetary ecosystem, and will probably be very important in Fi’s journey to assist working millennials get higher with their cash. With the profitable demonstration of the framework right this moment we’re excited to have all our customers expertise the ability and comfort of the AA integration as soon as it’s rolled out to all customers,” stated Sumit Gwalani, co-founder of Fi.

It is a creating story. Extra to comply with…

Supply feedproxy.google.com